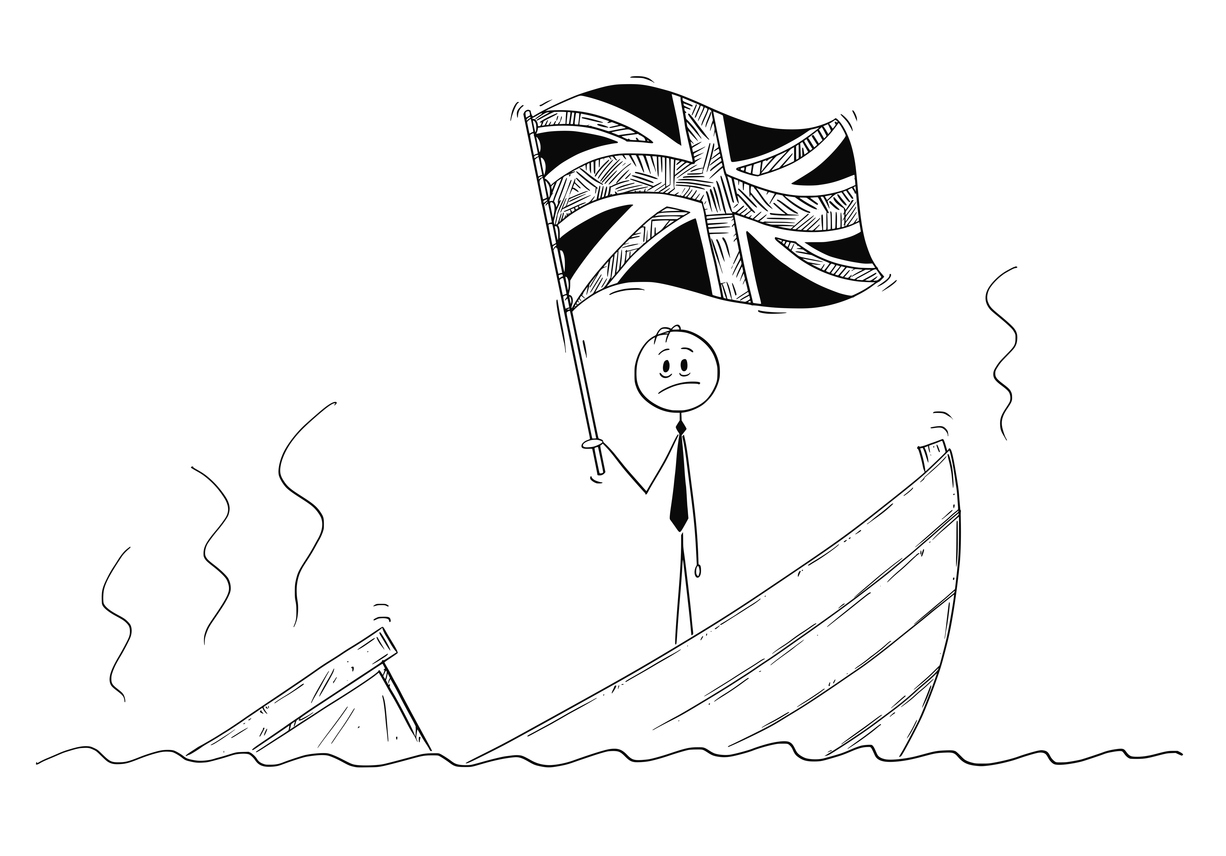

As of the beginning of October 2018, how the UK along with European firms based in the UK, will have access to the single market remains floating and unresolved. No one seems to know, including the politicians, if it will be a hard or soft Brexit. Not with standing, it will be difficult for small and medium UK based businesses to maintain profitability if they are not in the single market.

The solution is to relocate or part relocate your business to another EU country and Ireland is one of the main relocation points for many domestic and international firms based in UK.

At Dublin Mail Drop, have seen a major increase the past few weeks, from domestic and international firms in the UK, looking to relocated to Dublin, using virtual office services. Especially for small and medium firms, this is an efficient and affordable solution to relocate to Dublin. By using a Dublin virtual office, you can use the address for registering your company with the Companies Office along with Revenue, banking, insurance etc. There is also the option of various phone services, including calls answered in your company name.

If you need to meet a client, you can use the meeting room facilities on hand.

Why relocate to Ireland?

1. Ireland have one of the lowest tax rates for companies in Europe:

– 12.5% corporate tax rate, which is the lowest in Europe.

– Start-ups are exempt from corporation tax for 3 years, when profits are less thank €320k.

– Ireland offers a 25% tax credit for qualifying research & development expenditure and can be set against a company’s corporation tax liability.

2. Ireland regularly places highly in Forbes’ annual ranking of the best countries in the world to do business in, finishing in the top 10 in 2017.

3. Red tape is minimal in relation to setting up a company along with registering for tax.

4. Enterprise Ireland has a €10m fund per company in place, to attract international startups to Ireland.

5. Ireland have a highly educated, dynamic and open workforce. 49% of the population is aged under 35. This is more than that offered in the UK or EU.

In summary a move to Dublin is not that difficult, with minimal red tape in relation to company formation and registration for tax etc and affordable office relocation via virtual office services. By using a virtual office in Dublin you will have a physical address, instant access to post, Dublin phone number, calls answered in your company name, call forwarding and meeting room facilities on hand when you require them.

It’s a small price to protect your business and interests during these uncertain Brexit negotiations.